“Know your numbers.”

This is one of those phrases that gets bandied about all the time by entrepreneurs, marketers, and your overwhelming father-in-law accountant. So much so, it’s nearly a commandment in business.

But for as much press as this phrase gets, it’s still surprising how many practice owners don’t have a firm grasp on their numbers. Specifically when it comes to knowing the value of their patients.

Answer This Simple Question

If I were to come up to you and ask you the following question, would have an accurate answer?

“How much is a patient worth to you?”

If there was any hesitation on your part, then it’s time to do some digging.

The Importance of Lifetime Patient Value

Here’s why this is important to know…

Clearly understanding the lifetime value of your patient empowers you with opportunities for new patient acquisition, improved retention, referrals, and more. It gives you the upper hand over the competition (since most don’t take the time to figure this out). And it provides you with more predictability in your practice by improving accuracy in forecasting.

Why Is It Challenging to Assign a Fixed Value to the Lifetime Worth of a Dental Patient?

Setting a single, standardized figure for the lifetime value of a dental patient is no easy feat. Here’s why:

- Diverse Practice Sizes and Locations: Dental practices vary greatly in size and geographical location. A bustling urban clinic will have different overheads and patient demographics compared to a small-town practice. This diversity makes it impossible to apply a one-size-fits-all number.

- Fluctuating Market Dynamics: Dental markets are constantly changing due to economic pressures, technological advancements, and patient demands. These shifts influence how much each patient is worth over a lifetime, altering the value frequently.

- Varied Patient Needs and Services: Patients come with different needs—some require only routine check-ups, while others need extensive treatments. The diversity in services and frequency of visits leads to significant variations in the revenue each patient generates.

- Competitive Influences: In today’s competitive landscape, practices regularly offer discounts and specials to attract new patients. This competition for patient loyalty can alter the expected lifetime revenue, making fixed valuation ineffective.

- Insurance Variability: Differences in insurance coverage also play a crucial role. Practices that accept diverse insurance plans may see variations in revenue collected per patient based on the reimbursement rates, impacting lifetime value calculations.

In conclusion, due to these factors and more, it’s impractical to pin down a uniform figure for the lifetime value of a dental patient. Each practice must analyze its unique circumstances and patient base to develop a realistic estimate.

Understanding the Lifetime Value of a Dental Patient

To truly grasp the lifetime value of a dental patient, it’s crucial to move beyond generic industry figures. A frequently cited number is $10,000, but this doesn’t reflect the unique circumstances and strategies of individual practices.

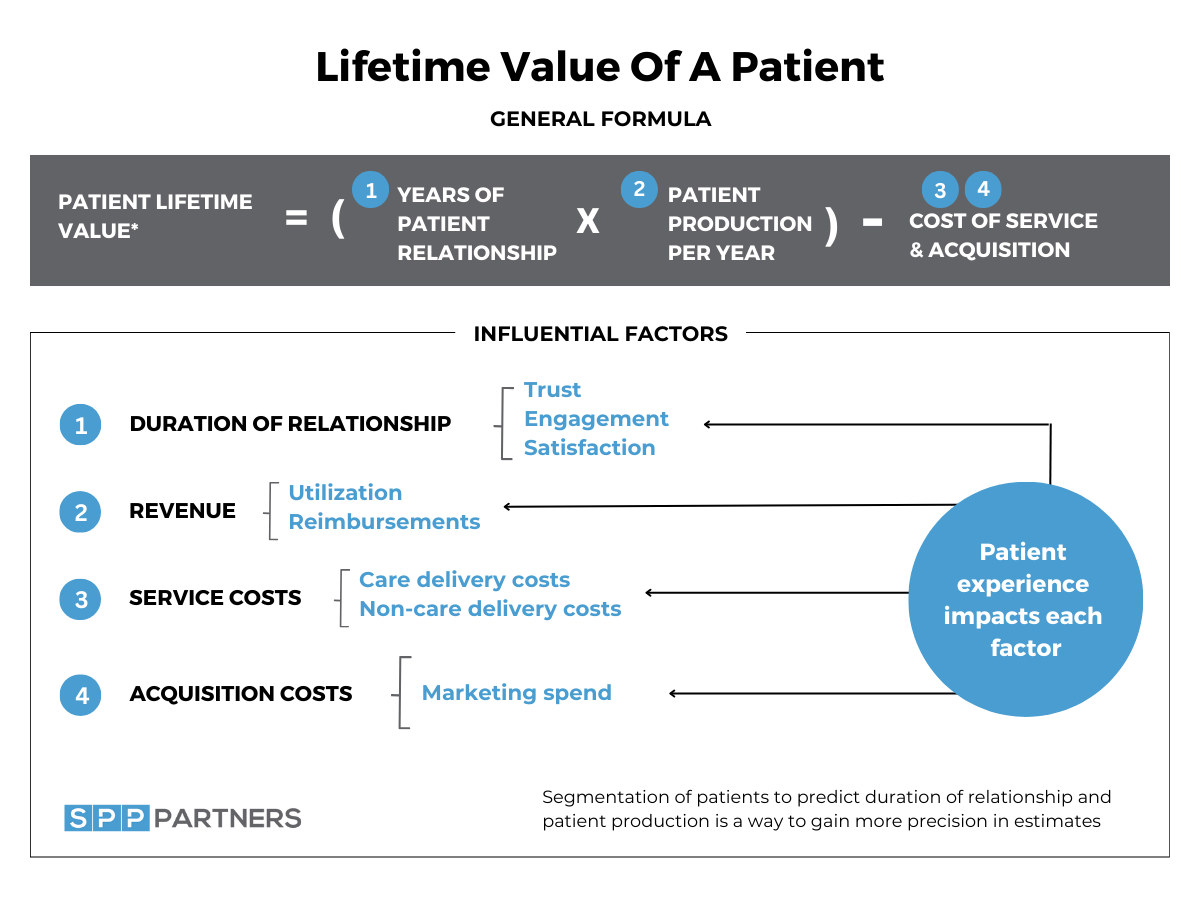

Defining Lifetime Value

The lifetime value (LTV) of a patient represents the total revenue a patient generates for your practice over their entire relationship with you, minus the costs of providing care. Here’s how to break it down:

- Patient Count: Start with the number of patients your practice currently serves.

- Time Horizon: Determine the duration you expect to maintain these patients; for argument’s sake, let’s use a 10-year period.

Calculating Lifetime Value

Consider this hypothetical scenario:

- Revenue per Patient: Assume each patient contributes $100 annually.

- Cost to Service: Each patient incurs $50 in annual costs.

- Patient Profit: This leaves a yearly profit of $50 per patient.

Using this information, if you have 1,000 patients, your calculation would be:

- Profit per patient per year: $50

- Total profit over 10 years: $50 (profit) x 1,000 (patients) x 10 (years) = $500,000

- Lifetime Value: $500 per patient

Tailoring Your Calculation

Remember, these figures are purely illustrative. The LTV can vary widely depending on your practice’s location, patient retention strategies, and additional services offered. Customizing this calculation to reflect your situation will yield a more accurate metric.

Here’s another approach to calculating Lifetime Value of a Patient:

- Determine the average annual production per patient (ie. How much does the average patient pay each year)

- Multiply that by the # of years an average patient remains active in your practice

- Then subtract the costs (service, marketing, etc)

**Download your copy of the Lifetime Value of a Patient Worksheet

Here’s an example from a practice in Arizona:

- Average production per patient: $876/year

- Average # of years a patient remains active: 3.5 years

- Average of associated costs: $525

Then plug those numbers into the equation:

$876 (prod. per year) x 3.5 (# of years) = $3,066

Then subtract the costs (-525) to get an average Lifetime Patient Value of $2,541.

Leveraging Lifetime Value of a Dental Patient for Marketing

Understanding the lifetime value (LTV) of a dental patient can revolutionize your marketing strategy. Here’s how you can effectively use LTV to guide both internal and external marketing efforts.

Internal Marketing: Enhancing Patient Retention

Dental practices often struggle with measuring the success of their internal marketing. Here’s where LTV comes into play:

- Gauge Effectiveness: Monitor changes in LTV to assess how well your patient retention strategies are working.

- An increase in LTV indicates successful retention efforts.

- A decrease might suggest that improvements are needed, or the competition is appealing to your patients more effectively.

- If LTV remains unchanged, there may be room for optimizing your patient engagement tactics.

By focusing on LTV, you gain measurable insights into how well you are serving and retaining your current patient base.

Understanding Churn Rate Calculation for a Dental Practice

Calculating the churn rate for a dental practice helps you understand the percentage of patients who stop patronizing your services over a specific period, typically a year.

Formula for Churn Rate in a Dental Office:

Churn Rate (%)= (The number of patients lost during a specified time period / total number of patients at the beginning of the same period) x 100

Where:

- Number of Patients Lost = Patients who have not returned for treatment or maintenance (e.g., exams, cleanings, or follow-ups) within a specific timeframe, typically 12 months.

- Total Patients at the Beginning = Active patients at the start of the period (e.g., patients seen within the last 12-18 months before the period began).

Churn Example:

- Starting Patient Count: 1,000 patients at the beginning of the year.

- Patients Lost During the Year: 100 patients (did not return for appointments or switched providers).

Churn Rate (%)=(100/1000) x 100 = 10%

This means 10% of your patients “churned” during that year.

Notes for Dental Practices:

- Define “Lost Patients” Clearly: A patient may not be “lost” if they are overdue for a cleaning but plan to return. Use a timeframe (e.g., no visits in the last 18 months) to categorize a patient as lost.

- Track Churn by Segment:

- New Patients: How many first-time patients return for a second visit?

- Long-Term Patients: How many regular patients fail to return?

- Aim for Low Churn:

- In dentistry, a churn rate under 10-15% annually is generally good, depending on your practice type and patient demographics.

- Retention Strategies:

- Send appointment reminders.

- Follow up with inactive patients.

- Offer loyalty programs or incentives to return.

- Improve patient experience and satisfaction.

By tracking and minimizing churn, you can build a more stable and growing patient base over time.

External Marketing: Acquiring New Patients

When attracting new patients, knowing your LTV offers crucial financial guidance:

- Budget Allocation: Determine how much you can invest in acquiring each new patient based on their LTV. For instance, if a patient’s LTV is $500, spending up to $500 on acquisition without incurring a loss becomes feasible.

- Profit Maximization: Increasing your patient’s LTV allows you to invest more in marketing while still securing profits. This way, you can outpace competitors in patient acquisition without jeopardizing your bottom line.

In essence, a clear understanding of dental patient LTV not only enhances current patient relationships but also improves your approach to bringing in new patients efficiently and profitably.

Look at how this changes the way you see new patient acquisition. Armed with the right data, you can more easily understand if your marketing campaigns are worth the investment.

Would you be willing to invest $50, $150, $350 dollars to acquire a new patient that will ultimately bring you $2,541? Is that a trade you’d be comfortable making?

When you don’t know the lifetime value of a patient, then are left guessing if your new patient acquisition costs are too high. For those people, it’s typically based on how they feel (anecdotal evidence – do I feel busy?), which is dangerous because we are often betrayed by our emotions. (emotional eating anyone??)

How Does Internal Marketing Impact the Lifetime Value of a Dental Patient?

Internal marketing plays a significant role in enhancing the lifetime value of a dental patient. Let’s break down how these efforts can make a difference:

- Increasing Patient Loyalty: Effective internal marketing keeps patients engaged with your practice through personalized communication and ongoing value. This strengthens their loyalty, leading to more frequent visits and a longer relationship with your practice.

- Improving Patient Experience: When patients encounter a welcoming and informed team, it boosts their overall experience. Staff training and streamlined communication are vital components of internal marketing. A satisfied patient is more likely to continue using your services and recommend them to others.

- Encouraging Treatment Acceptance: By educating patients on available treatments and consistently following up, you enhance their understanding and acceptance of necessary procedures. This can boost their lifetime value as they are more likely to opt for comprehensive care plans.

Measuring Success

To gauge the success of your internal marketing efforts, monitor changes in patient lifetime value:

- An Increase Indicates Success: If patient lifetime value goes up, your marketing strategies effectively enhance loyalty and satisfaction.

- A Decrease Signals Issues: A drop might point to lapses in patient engagement or satisfaction, possibly due to competitive external marketing.

- Stability Suggests Areas for Improvement: If there’s no change, it may be time to explore new strategies to improve patient interactions and increase their lifetime commitment.

By focusing on internal marketing, dental practices can ensure their patients not only stay longer but also engage more deeply with the services provided, maximizing lifetime value.

Account for Referrals

You can also factor into this equation patient referrals, since word-of-mouth is always a big driver for dental practices. Simply identify the average number of patient referrals you receive each year and then divide that by the number of patients you have. Then add that into your overall equation.

For example, let’s say that you typically average 15 new patient referrals each month. That comes to 180 patient referrals over the course of a year. At your practice, you have 1800 patients. So you divide 180 by 1800 to get 0.1. This means that you receive one new patient referral for every 10 patients.

Now you can include that into your overall equation as well by multiplying that number x your average lifetime patient value, and then adding that to your average lifetime patient value.

How Businesses Scale Using Lifetime Patient Value

As I mentioned before, having this type of data empowers you to be more aggressive in your patient acquisition campaigns. For example, instead of ‘feeling’ like paying $75 for a new patient is too much, you now know that you could spend 2, 3, even 5 times that and still come out on top in the end over time.

This is precisely how aggressive, growth-minded companies operate. They play the long-game.

Here’s a classic example: Icy Hot

Recognizing that those that used the product remained faithful product consumers, multiple times over, Icy Hot did a deal with hundreds of radio and TV stations. The agreement was that whenever those media stations had unused advertising time, they would pitch Icy Hot.

In exchange, Icy Hot would give them all the revenue from the first sale. (Actually it was more than that)

Why did they do this?

Because they knew that the bulk of the value of these customers came from the many repurchases after that initial sale. They realized that they could afford to give away the revenue from the initial sale because they would easily make it up on the back end. In other words, they employed a loss leader approach.

They used this strategy to acquire thousands upon thousands of new, loyal customers. Eventually they sold the company for $60 million to Searle & Co.

How External Marketing Boosts New Patient Acquisition

External marketing plays a pivotal role in attracting new dental patients by enhancing the perceived value of dental services and strategically reaching broader audiences. By focusing on increasing the lifetime value of existing patients, dental practices can justify and sustain higher spending on marketing efforts.

Building a Strong Brand Presence

Creating a recognizable and trustworthy brand is essential. When potential patients come across a practice that has a strong online and offline presence, they are more likely to consider it for their dental needs. Effective branding makes use of:

- Social Media: Platforms like Facebook and Instagram allow practices to share testimonials, educational content, and promotions, reaching a wider audience.

- Content Marketing: Blogging or creating informative videos about dental health increases visibility, authority, and trust in the eyes of potential patients.

Targeted Advertising

Investing in targeted advertising is crucial. Google Ads and Facebook Ads offer precise targeting options, allowing dental practices to reach specific demographics. By understanding who the most valuable patients are, practices can craft campaigns that appeal directly to these individuals.

Enhanced Patient Experience Online

A user-friendly website with clear navigation and easy access to information increases the likelihood of converting visitors into patients. Features such as online appointment booking and virtual consultations provide convenience and encourage prospective patients to make contact.

Reputation Management

Online reviews and ratings significantly influence decision-making processes for potential dental patients. Encouraging satisfied patients to leave positive reviews on platforms like Yelp and Google My Business can enhance credibility and attract new patients.

Measuring Success

Utilizing analytics tools to track the performance of marketing campaigns helps dental practices understand which strategies are most effective. By knowing the patient lifetime value, practices can align their marketing investments with the expected returns, ensuring sustainable growth in patient acquisition.

By strategically implementing these external marketing techniques, dental practices can increase their reach, attract more patients, and ultimately, improve their profitability.

Next Steps

First thing to do is to determine the average lifetime value of your patients. Download your worksheet and punch in your numbers.

Next, review your practice goals and marketing campaigns. How can you accelerate your practice growth knowing your patient lifetime value? In what ways can you be more aggressive in attracting new patients?

Want An Outsider’s Perspective?

Want an extra set of eyes, a brainstorm session, or a long list of not-that-funny dad jokes?

Schedule a quick, 20-minute Discovery Call. I might even wear my favorite monocle.